We are now on Telegram. Click to join We are now on Telegram. Click to join |

We are now on WhatsApp Channel. Click to join We are now on WhatsApp Channel. Click to join |

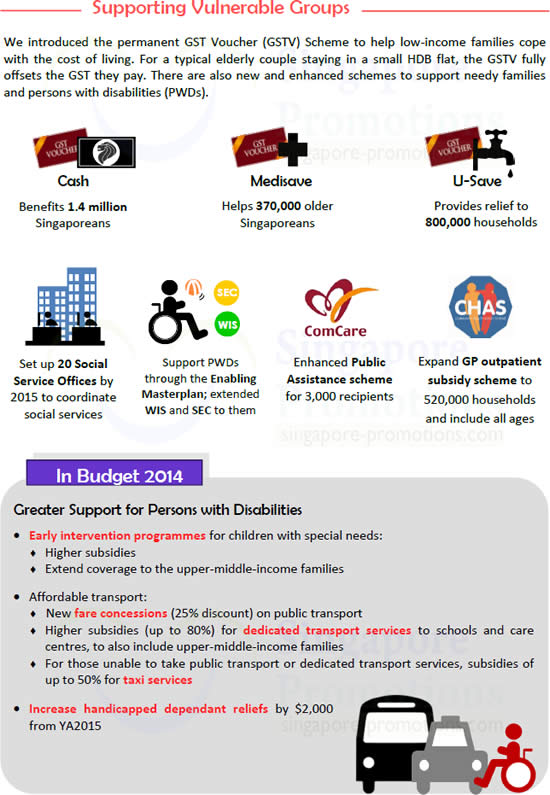

Here are all the measures the Budget 2014 will be bringing for all households announced by Minister for Finance, Mr Tharman Shanmugaratnam in Parliament on 21 February 2014.

No business related benefits are listed here

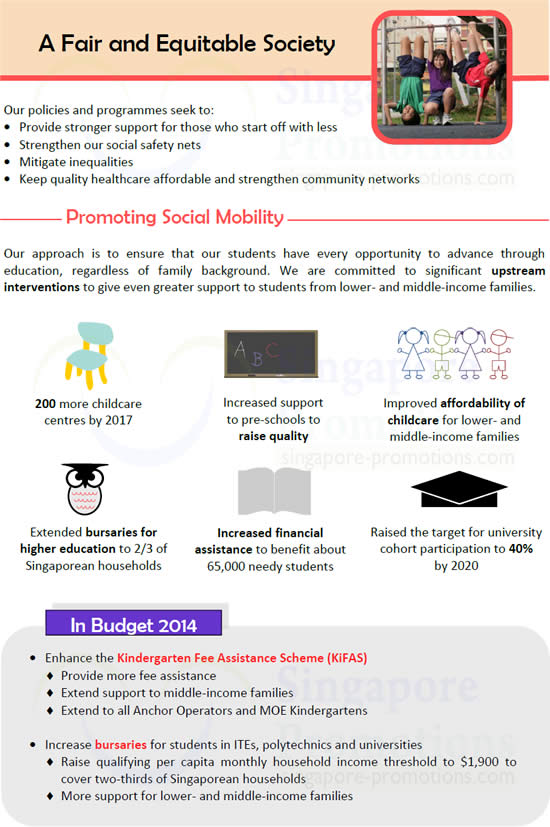

(A) Promoting Social Mobility

(A1) Pre-school Education

To enhance the affordability of pre-schools for lower- and middle-income families, the

Government will:

- Provide more fee assistance through the Kindergarten Fee Assistance Scheme (KiFAS) to lower-income families, and extend support to middle-income families.

- Make available KiFAS to all Anchor Operators and MOE kindergartens.

More details will be provided at the Ministry of Social and Family Development’s Committee of Supply.

(A2) Bursaries at Institutes of Higher Learning

To enhance the affordability of higher education for lower- and middle-income families, the

Government will:

- Significantly increase university, polytechnic and ITE bursaries.

- Raise the per capita monthly household income threshold for bursaries from $1,700 to $1,900 from Academic Year 2014. This will benefit the two-thirds of all Singaporean households.

More details will be provided at the Ministry of Education’s Committee of Supply.

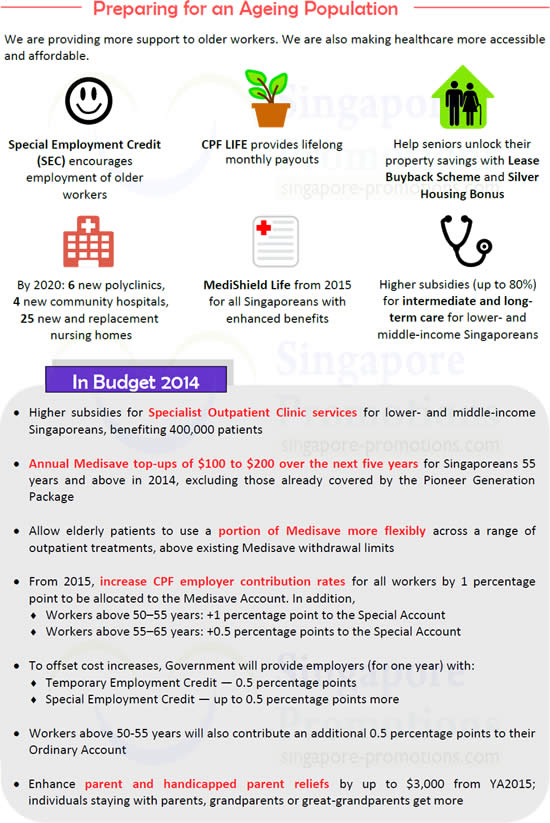

(B) Enhancing Healthcare Affordability

(B1) MediShield Life Subsidies

To ensure that premiums for the new MediShield Life remain affordable, the Government will provide permanent subsidies for lower- and middle-income groups so that they can fully pay their remaining premiums out of regular Medisave contributions.

To ease the transition into MediShield Life, the Government will also provide subsidies to offset premium increases for the first few years. Details of the subsidies will be finalised after the MediShield Life Committee has completed its work.

(B2) Specialist Outpatient Clinics (SOC) Subsidies

The subsidies for SOC services for lower- and middle-income Singaporeans, currently at 50%, will be increased to 70% and 60% respectively. This will be implemented from September 2014.

Table 1: Enhancements to Subsidy for SOC services

| Household Income Per Capita | Annual Value of Home* | Current | Revised |

|---|---|---|---|

| Up to $1,100 | Up to $13,000 | 50% | 70% |

| $1,101 to $1,800 | $13,001 to $21,000 | 60% | |

| More than $1,800 | More than $21,000 | 50% |

*The Annual Value of Home will only be considered if the household does not have an income.

Subsidies for medication will be similarly enhanced. The enhancements will be introduced early next year. The Ministry of Health will update on the details at a later date.

(B3) Increase in CPF Medisave Contribution Rates

To help Singaporean workers save for their healthcare needs, the employer CPF contribution rate will be increased by 1 percentage point for all workers. This increase will be channelled into the Medisave Account.

To alleviate the impact on businesses, employers will receive a one-year Temporary

Employment Credit to offset 0.5 percentage points of wages up to the CPF salary ceiling of $5,000.

These changes will take effect from January 2015.

(B4) More Flexible Use of Medisave for Elderly Singaporeans

Elderly Singaporeans will be allowed to use a portion of their Medisave more flexibly across a range of outpatient treatment, on top of the existing Medisave withdrawal limits for specific chronic conditions and other treatments.

More details will be provided at the Ministry of Health’s Committee of Supply.

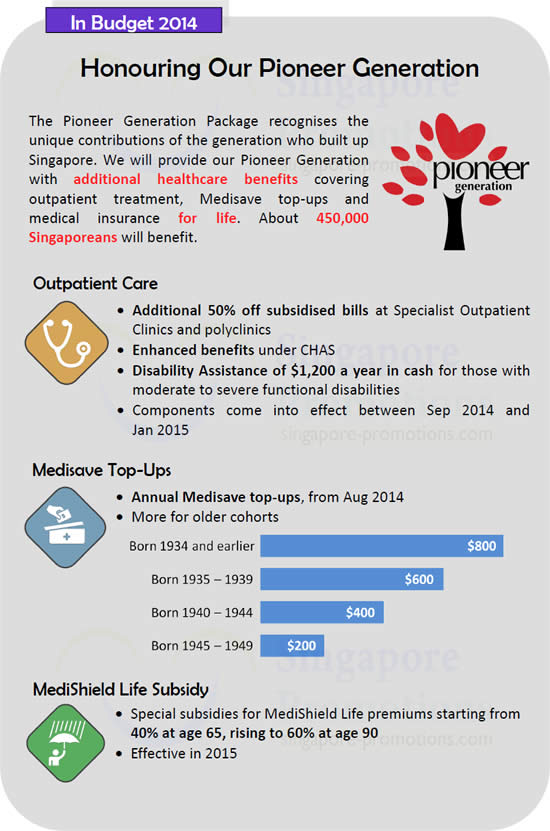

(C) Honouring our Pioneer Generation

To honour and recognise the Pioneer Generation for their contributions to nation-building, the Pioneer Generation will receive support for their healthcare needs for the rest of their lives.

(C1) Additional Subsidies for Outpatient Care

The Pioneer Generation will receive further subsidies for outpatient care in polyclinics, SOCs and General Practitioner clinics on the Community Health Assist Scheme (CHAS).

- A further 50% discount off their subsidised bills at SOCs and polyclinics.

- All in the Pioneer Generation will be placed on CHAS, regardless of income or housing type. Those already on CHAS will receive additional subsidies.

- Members of the Pioneer Generation who have moderate to severe functional disabilities will receive cash assistance of $1,200 a year under the Pioneer Generation Disability Assistance Scheme.

The subsidies for SOC and polyclinic services, and Pioneer Generation Disability Assistance Scheme, will be implemented in September 2014. The additional CHAS benefits will be implemented in January 2015. More details will be provided at the Ministry of Health’s Committee of Supply.

(C2) Medisave Top-Ups

The Government will provide annual Medisave Top-Ups of $200 to $800 for all in the Pioneer Generation, with higher amounts for older Pioneer Generation cohorts. It will be paid out from August 2014.

Table 2: Medisave Top-Ups for Pioneer Generation

| Age in 2014 (Birth Cohort) | Annual Medisave Top-Up |

| 65-69 (1945-1949) | $200 |

| 70-74 (1940-1944) | $400 |

| 75-79 (1935-1939) | $600 |

| 80+ (1934 and earlier) | $800 |

(C3) MediShield Life Subsidy

To provide the Pioneer Generation with the assurance that their premiums will be affordable as they grow older, all Pioneer Generation members will enjoy subsidies starting from 40% at age 65, rising to 60% at age 90. This will be implemented at the end of 2015, when MediShield Life is rolled out.

(C4) Pioneer Generation Fund ($8 billion)

An $8 billion Pioneer Generation Fund will be set up to meet the full estimated cost of the

Pioneer Generation Package over time.

(D) Further Help for Older Singaporeans

(D1) 5-Year CPF Medisave Top-Up ($440 million)

Singaporeans who were born on or before 31 Dec 1959 (i.e. aged 55 and above in 2014) and who do not enjoy Pioneer Generation benefits will receive an annual Medisave top-up of

$100 to $200 over the next five years. The amount an eligible Singaporean will receive is based on the value of his/her home:

The Medisave top-up will be paid out from August 2014.

(D2) Increase in CPF Contribution Rates for Older Workers

To boost the retirement adequacy of older Singaporeans, the Government will raise their CPF contribution rates. These are on top of the increase in employer CPF contribution rates for the Medisave Account for all workers.

All increases in employer contributions will be allocated to the Special Account. The 0.5 percentage point increase in contribution rate from employees aged 50 to 55 years will go to the Ordinary Account.

Table 4: Increase in CPF Contribution Rates for Older Workers

| Employee Age(Years) | New Contribution Rates* from Jan 2015 (% of wage)(% point increases are in brackets): | ||

|---|---|---|---|

| Employer | Employee | Total | |

| Above 50 – 55 | 16 (+2) | 19 (+0.5) | 35 (+2.5) |

| Above 55 – 60 | 12 (+1.5) | 13 | 25 (+1.5) |

| Above 60 – 65 | 8.5 (+1.5) | 7.5 | 16 (+1.5) |

| Above 65 | 7.5 (+1) | 5 | 12.5 (+1) |

*Includes 1 percentage point increase in Medisave contribution rate for all workers introduced in Budget 2014 (B2).

To help employers adjust to this increase, the Government will provide a one-year increase in the Special Employment Credit of up to 0.5 percentage points. This comes on top of the existing Special Employment Credit of 8% of wages, and will offset the increase in older worker contribution rates.

The changes will take effect from January 2015.

(D3) Enhancement of Parent Reliefs ($27 million per year)

To give greater encouragement and recognition to individuals supporting their parents, grandparents, and great-grandparents (including in-laws), the Parent Relief and Handicapped Parent Relief will be enhanced as follows:

Table 5: Parent Relief and Handicapped Parent Relief

In recognition that the care for these elderly dependants is a shared responsibility among family members, IRAS will allow apportionment of the Parent Relief and Handicapped Parent Relief from Year of Assessment (YA) 2015.

(E) Greater Support for Persons with Disabilities

(E1) Strengthening Early Intervention

Subsidies for the Early Intervention Programme for Infants and Children (EIPIC) will be enhanced:

- Raise the universal base subsidy for Singaporean children enrolled in EIPIC from $300 to $500 a month.

- Extend subsidies to cover 80% of households. Those earning above the median income will benefit from a further 20% to 50% subsidy, in addition to an enhanced $500 base subsidy.

(E2) Transport for Persons with Disabilities

To make transport more affordable for the disabled community, the Government will introduce:

- Subsidies to cover up to 80% of the cost of dedicated transport to access school and care services. This will apply to the lower two-thirds of households.

- A new Taxi Subsidy Scheme to subsidise up to 50% of the cost of taxi travel for those who are unable to travel by public transport or tap on dedicated transport. This will apply to the lower half of households.

More details will be provided at the Ministry of Social and Family Development’s Committee of Supply.

(E3) Enhanced Handicapped Dependant Reliefs

To provide greater support for individuals with handicapped dependants, the amount of handicapped spouse relief, handicapped sibling relief and handicapped child relief will be increased by $2,000 with effect from YA 2015 as follows:

Table 6: Handicapped Dependant Reliefs

| Type of Relief | Current Relief | New Relief |

|---|---|---|

| Handicapped Spouse Relief | $3,500 | $5,500 |

| Handicapped Sibling Relief | $3,500 | $5,500 |

| Handicapped Child Relief | $5,500 | $7,500 |

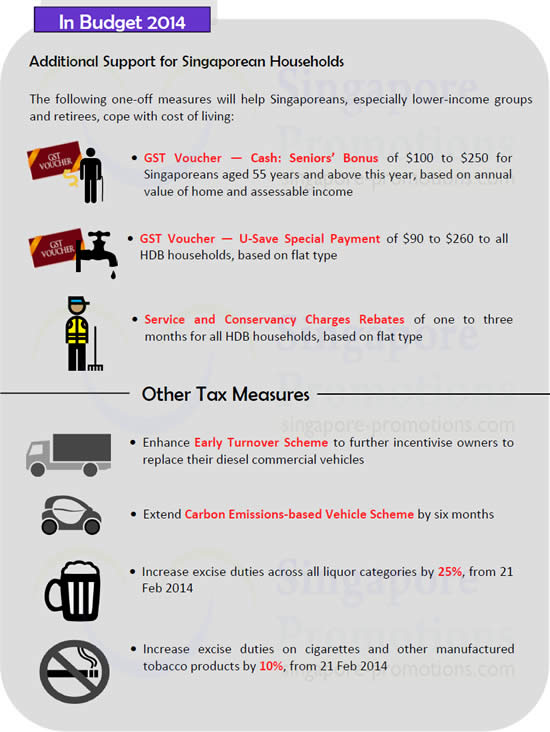

(F) Additional Support for Singaporean Households

(F1) One-off GST Voucher (GSTV) – Cash: Seniors’ Bonus ($170 million)

To help seniors with their cost of living, the Government will provide a one-off GSTV – Cash: Seniors’ Bonus for all eligible Singaporeans aged 55 and above.

This means that they will get double the GSTV – Cash payment in 2014. About 675,000 seniors will benefit.

Table 7: 2014 GST Voucher – Cash: Seniors’ Bonus

| For Singaporeans aged 55 and above in 2014 | Annual Value of Home as at 31 Dec 2013 | |

|---|---|---|

| Assessable Income for YA 2013 | Up to $13,000 | $13,001 to $21,000 |

| Up to $26,000 | $250 | $100 |

(F2) One-off GSTV – U-Save Special Payment ($110 million)

To help households with their cost of living, the Government will provide a one-off GSTV – U-Save Special Payment, with those in smaller flats receiving more. It will be paid out on top of the regular GSTV – U-Save payments. About 800,000 households will benefit.

Table 8: GST Voucher 2014 – U-Save Special Payment

| HDB Flat Type | % of Regular Payment | GST Voucher – U-Save Regular Payment | GST Voucher – U-Save Special Payment |

|---|---|---|---|

| 1-room | 100% | $260 | $260 |

| 2-room | 100% | $260 | $260 |

| 3-room | 75% | $240 | $180 |

| 4-room | 50% | $220 | $110 |

| 5-room | 50% | $200 | $100 |

| Executive | 50% | $180 | $90 |

(F3) One-off Service and Conservancy Charges (S&CC) Rebates ($80 million)

To help households with their general household expenses, the Government will provide

S&CC rebates in 2014. About 800,000 households will benefit.

| HDB Flat Type | S&CC Rebates (months) |

|---|---|

| 1-room | 3 |

| 2-room | 3 |

| 3-room | 2 |

| 4-room | 2 |

| 5-room | 1.5 |

| Executive | 1 |

Table 9: 2014 S&CC Rebates

(G) Other Measures

(G1) Top-up to Lifelong Learning Endowment Fund ($500 million)

In line with the long-term commitment to Continuing Education and Training, the Government will top up the Lifelong Endowment Fund by $500 million, bringing the total fund size to $4.6 billion.

(G2) Extension of Carbon Emissions-based Vehicle Scheme

The Carbon Emission-based Vehicle Scheme will be extended to June 2015, with a view to refining the Scheme thereafter.

(G3) Increase in Tobacco Excise Duties ($70 million per year)

Excise duties for cigarettes and other manufactured tobacco products will be increased by 10% to $388 per kg or 38.8 cents for every gram or part thereof of per stick of cigarette, from $352 per kg or 35.2 cents for every gram or part thereof of per stick of cigarette. This will take effect from 21 February 2014.

(G4) Increase in Liquor Excise Duties ($120 million per year)

The excise duty rate of all liquor types will be raised by 25%. The duty rate of shandy will also be rationalised to that for beer. These changes will take effect from 21 February 2014.

Visit www.singaporebudget.gov.sg for more information.

Leave a Reply