We are now on Telegram. Click to join We are now on Telegram. Click to join |

Revised Fixed Deposit Promotion Rates from 6 Oct 2025

Update 13 Oct: BOC S’pore Updates Fixed Deposit Promo Rates from 13 Oct 2025, Earn Up To 1.35% p.a.

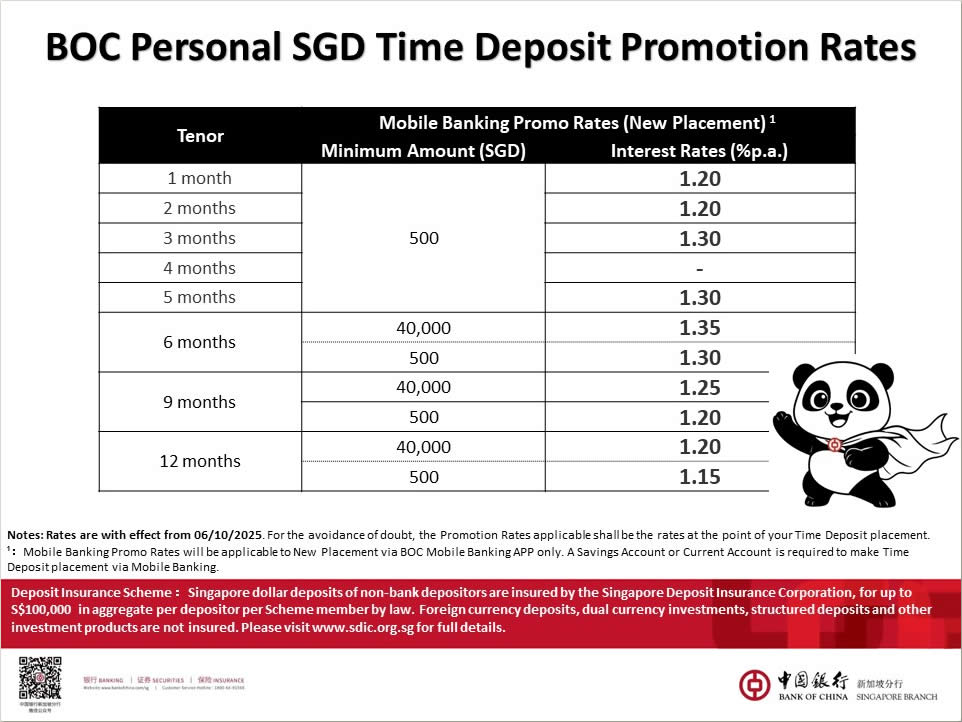

Bank of China (BOC) Singapore has revisedtheir personal fixed deposit (FD) promotional rates, effective from 6 October 2025. This latest revision offers customers an opportunity to earn up to 1.35% p.a. – an appealing return in Singapore’s current savings landscape, especially for short- to mid-term tenors.

This marks a slight increase of selected tenors compared to the earlier rates on 22 Sep 2025.

The updated promotional rates apply exclusively to new time deposit placements made via the BOC Mobile Banking App. These rates are designed to reward digital banking customers with higher interest returns, offering both convenience and better value compared to traditional over-the-counter placements 💰.

📊 Updated BOC SGD Time Deposit Rates (Effective 6 Oct 2025)

Below are the latest promotional rates for SGD time deposits placed via mobile banking:

| Tenor | Mobile Banking Promo Rates (New Placement) | |

|---|---|---|

| Minimum Amount (SGD) | Interest Rates (% p.a.) | |

| 1 month | 500 | 1.20 |

| 2 months | 1.20 | |

| 3 months | 1.30 | |

| 4 months | – | |

| 5 months | 1.30 | |

| 6 months | 40,000 | 1.35 |

| 500 | 1.30 | |

| 9 months | 40,000 | 1.25 |

| 500 | 1.20 | |

| 12 months | 40,000 | 1.20 |

| 500 | 1.15 | |

*All rates are indicative and subject to change at the bank’s discretion without prior notice.

📌 Key Terms & Highlights

- Promotion valid for individual account holders only.

- A savings or current account is required to facilitate placement via the BOC Mobile Banking App.

- Premature withdrawal may result in loss or reduction of interest earned.

- Promotional rates are applicable only to new placements and not renewals.

- All eligible deposits are protected under the Singapore Deposit Insurance Scheme (SDIC) up to S$100,000 per depositor per scheme member bank.

📱 How to Apply

To enjoy these promotional rates, customers can simply log in to the BOC Mobile Banking App and select “Time Deposit” to initiate a placement. This streamlined process eliminates the need for in-branch visits while ensuring you lock in the best available rates.

For more details, visit the official BOC Singapore website. Those who prefer in-person service may locate the nearest branch through the BOC branch locator.

To compare BOC’s latest FD promotions with other banks in Singapore, check out this updated guide.

With interest rates as high as 1.35% p.a. for 6-month deposits, BOC Singapore’s new FD promotion provides a strong option for savers seeking secure, short-term returns. Whether you’re parking idle cash or diversifying your portfolio, these rates are worth considering – especially when placed conveniently through the BOC Mobile Banking App 📲.

Disclaimer: All information is accurate as of 6 Oct 2025 and subject to change. Customers should verify the latest rates and terms directly with Bank of China (Singapore).

Leave a Reply