![]()

Oh no, the promo has ended

Don't miss out again, get the latest news via

![]()

| Starts | 4 Jan 2015 (Sun) | Ends | 31 Mar 2015 (Tue) |

|---|---|---|---|

| Location | OCBC |

We are now on Telegram. Click to join We are now on Telegram. Click to join |

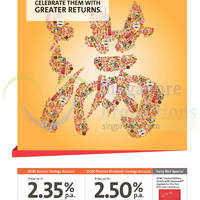

It’s the little things that matter. Celebrate them with greater returns.

OCBC Bonus+ Savings Account

Enjoy up to 2.35% p.a. with minimum deposit of S$10,000

Initial deposit S$10,000 fresh funds

Minimum monthly balance S$3,000. S$2 fall below fee applies

Earn higher interest if you do not make any withdrawals monthly and quarterly. Plus, enjoy an even sweeter interest rate when you top up fresh funds of S$10,000 and make no withdrawals within that quarter.

Also, with no lock-in period, you can enjoy the flexibility to deposit and withdraw anytime. If you withdraw within the month, you only receive 0.05% p.a. monthly base rate.

- No withdrawals this month? – 0.60 % a year

- No withdrawals this quarter? – 1.15 % a year

- Top up fresh funds of S$10,000 with no withdrawals this quarter? – 2.35 % a year

Fresh funds refer to funds not transferred or withdrawn from existing OCBC Bank order/dedeposit accounts and re-deposited or funds in the form of OCBC Bank cheque/cashier’s mand drafts.

All funds in the Bonus+ Savings Account enjoy a monthly base interest of 0.05% p.a. If no withdrawals are made, the interest rate will be 0.60% p.a. for 2 months and 1.15% p.a. for the third month. If no withdrawals are made in the quarter and there is minimum $10,000 fresh funds deposit, the interest rate will be 2.35% p.a. for the third month. The maximum effective interest rate for the account will be 1.18% p.a.

These 3-month periods are defined as the calendar quarters of the year:

- January, February and March

- April, May and June

- July, August and September

- October, November and December

OCBC Premier Dividend + Savings Account

Enjoy up to 2.50% p.a. with minimum deposit of S$100,000

Receive superior returns every month with Premier Dividend+ Savings Account

Initial deposit S$100,000 in fresh funds*

Minimum monthly balance S$0

Earn higher interest if you do not make any withdrawals monthly and quarterly. Plus, enjoy an irresistible interest rate when you top up fresh funds of S$100,000 and make no withdrawals within that quarter. Also, with no lock-in period, you can enjoy the flexibility to deposit and withdraw anytime. If you withdraw within the month, you only receive 0.05% p.a. monthly base rate.

- No withdrawals this month? 0.65% p.a.

- No withdrawals this quarter? 1.25% p.a.

- Top up fresh funds of S$100,000 with no withdrawals this quarter? 2.50% p.a.

All funds in the Premier Dividend+ Savings Account enjoy a monthly base interest of 0.05% p.a. If no withdrawals are made, the interest rate will be 0.65% p.a. for 2 months and 1.25% p.a. for the third month. If no withdrawals are made in the quarter and there is minimum $100,000 fresh funds deposit, the interest rate will be 2.50% p.a. for the third month. The maximum effective interest rate for the account will be 1.27% p.a.

These 3-month periods are defined as the calendar quarters of the year:

- January, February and March

- April, May and June

- July, August and September

- October, November and December

Early Bird Special

OCBC Limited Edition Clutch with Swarovski® Crystals for the first 800 new customers.

Enjoy additional S$388 or S$888 Cash Credit with minimum deposit of S$350,000 or S$800,000 respectively into your Premier Dividend+ Savings Account.

Other terms and conditions apply.

See ad image for price list and more details

Click on thumbnail[s] to enlarge. Sales on until 31 Mar 2015. For more info, click OCBC Bonus+ Savings Account or OCBC Premier Dividend + Savings Account.

Leave a Reply