![]()

Sorry, the deal has ended

Don't miss out again, get the latest news via

![]()

| Starts | 1 Apr 2024 (Mon) | Ends | 31 May 2024 (Fri) |

|---|---|---|---|

| Location | Standard Chartered |

We are now on Telegram. Click to join We are now on Telegram. Click to join |

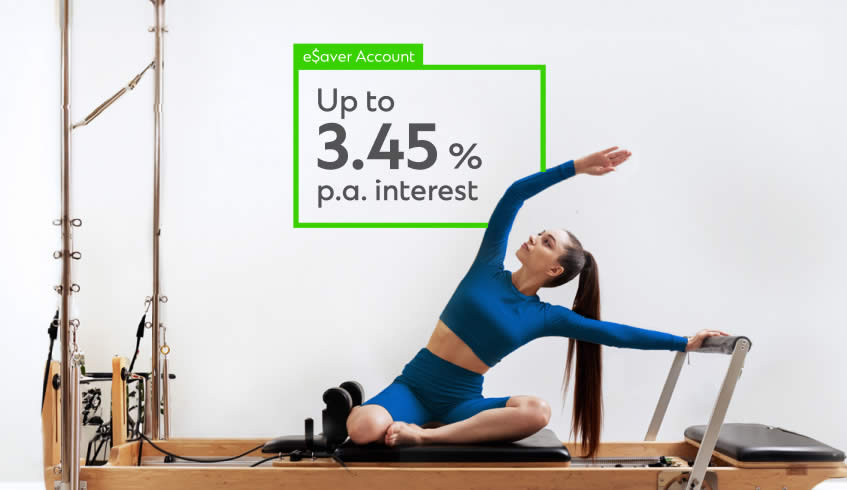

Maximise Your Savings: Standard Chartered’s e$aver Account Promises Lucrative Returns

UPDATE 1 June: Standard Chartered Singapore Offers 3.55% p.a. for Fresh Funds in e$aver Savings Accounts till 31 July 2024

In an unprecedented move, Standard Chartered Singapore has announced a lucrative offer for its e$aver account holders. Starting immediately and valid until 31 May 2024, customers can enjoy an interest rate of up to 3.45% p.a. on eligible deposit balances reaching S$2 million. This offer is applicable for new incremental fresh funds, with the comparison benchmark being the average daily balance of March 2024.

The term ‘fresh funds’ is defined as capital that is not transferred from any existing account within the bank nor withdrawn and redeposited within a 30-day window of the Promotion Period.

This strategic initiative is part of Standard Chartered’s commitment to providing competitive financial solutions to its clients. The bank’s latest promotion is set to attract a broad range of customers, offering them the opportunity to grow their savings significantly without any lock-in period.

The promotion details are as follows:

| Prevailing Interest Rate on Deposit Balance | Bonus Interest Rate on Eligible Incremental Balance | Total Interest Rate on Eligible Incremental Balance |

|---|---|---|

| 0.05% p.a. | 3.40% p.a. | 3.45% p.a. |

Eligibility for this offer extends to:

- Singapore citizens

- Singapore permanent residents

- Foreign nationals

All applicants must be at least 18 years of age to qualify.

For more detailed information and to take advantage of this offer, interested parties are encouraged to visit the official Standard Chartered website. Additionally, comparisons of the best deposit rates available can be found here

Leave a Reply