We are now on Telegram. Click to join We are now on Telegram. Click to join |

SingFinance (Sing Investments & Finance Limited) has refreshed its Singapore Dollar fixed deposit (FD) promotional rates from 26 Nov 2025, with the latest campaign offering secure returns of up to 1.4% p.a. 🎉

This revision follows the earlier update on 13 Nov 2025 and introduces modest enhancements on selected tenors, giving customers more choices across different deposit durations.

Overview of SingFinance FD promos from 26 Nov 2025

Under the refreshed promotion, SingFinance is running three main sets of Singapore Dollar fixed deposit offers:

- 61st Anniversary Fixed Deposit Promotion – longer-term tenors of 1, 2 and 3 years for fresh funds of at least S$10,000. The rates for these are unchanged from the previous update

- Online placement promotion – short to medium-term tenors from 1 to 12 months, starting from just S$1,000, with higher rates for S$10,000 and above.

- Over-the-counter (OTC) branch placement – in-branch promotions for customers who prefer face-to-face service, with a minimum placement of S$10,000.

Across these options, promotional rates currently range from 1.10% p.a. to 1.40% p.a., depending on tenor, channel and deposit size, with the headline rate of 1.4% p.a. available on selected short- to mid-term tenors.

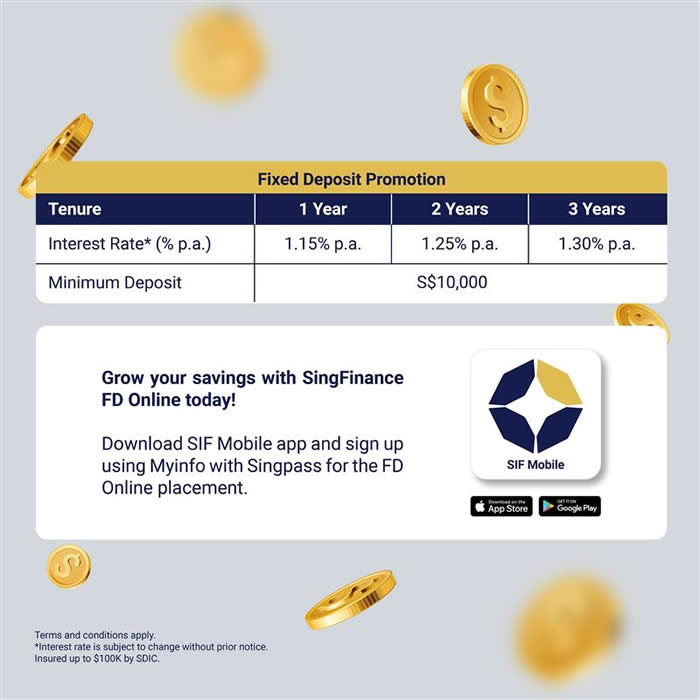

61st Anniversary Fixed Deposit Promotion

Under the 61st Anniversary Fixed Deposit Promotion, customers who place at least S$10,000 in fresh funds can lock in attractive longer-term tenors with guaranteed returns for up to three years. This may suit savers who are comfortable setting aside funds for a longer period in exchange for stable, predictable returns.

| Tenor | Minimum Deposit Amount | |

|---|---|---|

| $10,000 | ||

| 1 year | 1.15% p.a. | |

| 2 years | 1.25% p.a. | |

| 3 years | 1.30% p.a. | |

These anniversary rates may appeal to customers who:

- Have at least S$10,000 in spare cash that is not needed for day-to-day expenses.

- Prefer locking in a known rate for 1, 2 or 3 years instead of monitoring rates frequently.

- Are building a longer-term savings plan in Singapore Dollars.

Online placement

For customers who prefer to transact digitally, SingFinance offers promotional FD rates via online placement, starting from a minimum placement of just S$1,000. Higher promotional rates are available for deposits of S$10,000 and above.

| Tenor | Minimum Deposit Amount | |

|---|---|---|

| $1,000 | $10,000 | |

| 1 month | 1.20% p.a. | 1.30% p.a. |

| 3 months | 1.20% p.a. | 1.40% p.a. |

| 6 months | 1.20% p.a. | 1.40% p.a. |

| 12 months | 1.10% p.a. | 1.15% p.a. |

From the table above, the highest online rate of 1.40% p.a. is available for S$10,000 placements over 3 months and 6 months. For customers who prefer a lower entry amount, the S$1,000 tier still offers a flat 1.20% p.a. on 1-, 3- and 6-month tenors, which may suit those who are trying out SingFinance’s online platform or building an FD ladder.

The 12-month online tenors pay 1.10% p.a. for S$1,000 placements and 1.15% p.a. for S$10,000 and above, suitable for savers who prefer a slightly longer commitment without locking funds up for multiple years.

Over the counter placement

Customers who value face-to-face service can opt to place their fixed deposits at SingFinance branches, where staff can assist with questions and documentation. These branch promotions require a minimum deposit of S$10,000.

| Tenor | Minimum Deposit Amount |

|---|---|

| $10,000 | |

| 1 month | 1.30% p.a. |

| 3 months | 1.35% p.a. |

| 6 months | 1.40% p.a. |

| 12 months | 1.15% p.a. |

For over-the-counter placements, the highest promotional rate of 1.40% p.a. is offered on the 6-month tenor. Shorter 1- and 3-month placements earn 1.30% p.a. and 1.35% p.a. respectively, while the 12-month tenor is set at 1.15% p.a.. Customers who prefer human assistance or are placing larger sums may find branch placement more reassuring.

📋 Key notes & considerations

Before committing funds, customers should take note of the following key conditions and safeguards:

- Applies to personal accounts and fresh funds only; customers should confirm with SingFinance what qualifies as fresh funds before placing.

- Promotional rates are subject to change based on prevailing market conditions and may be revised or withdrawn without prior notice.

- Customers should review the full terms and conditions, including early withdrawal clauses, before placement.

- Interest is paid upon maturity; early withdrawal may lead to reduced returns or loss of interest, depending on the terms.

- Eligible SGD deposits of non-bank depositors are insured up to S$100,000 per depositor per Scheme member under the Deposit Insurance (DI) Scheme administered by SDIC.

As with all fixed deposits, customers should ensure they will not need the funds urgently during the chosen tenor, as breaking the FD early typically results in lower or forfeited interest. Those who anticipate possible cash needs may wish to split their funds across multiple tenors or combine fixed deposits with more liquid savings options.

Who might find these FD promos suitable?

- Conservative savers who prefer guaranteed returns in Singapore Dollars instead of market-linked products.

- Retirees or near-retirees who value predictable interest and capital preservation.

- Working adults who already have emergency funds set aside and wish to put surplus cash to work for 3 to 12 months.

- Customers building an FD ladder by staggering placements across 1-, 3-, 6- and 12-month tenors, or combining shorter tenors with the 1- to 3-year anniversary FDs.

As with any financial product, customers should consider their own risk appetite and cash flow needs, and may wish to seek independent financial advice if they are unsure.

📝 How to apply

Applicants can conveniently apply via the SingFinance Fixed Deposit page, where they can view the latest promotional details and begin an online placement using their SingFinance account.

- Visit the SingFinance Fixed Deposit page and access the online placement facility.

- Select the preferred tenor and indicate the intended deposit amount, ensuring the minimum placement requirements are met.

- Confirm the details and complete the placement according to the on-screen instructions.

Those who prefer to visit in person can locate their nearest branch through the branch locator. Identification documents and relevant account information may be required for verification during placement, especially for first-time customers.

With refreshed fixed deposit promotional rates from 26 Nov 2025, SingFinance provides a range of options for savers who value stability and guaranteed returns in Singapore Dollars. Between the 61st Anniversary multi-year promotion, flexible online placements starting from S$1,000 and competitive branch rates, customers can mix and match tenors and channels to suit their needs while earning up to 1.4% p.a. on selected FDs. As always, prospective depositors should read the full terms and conditions and confirm the latest rates with SingFinance before placing their funds. 😊

To compare SingFinance’s fixed deposit promotion against other banks and finance companies in Singapore, readers can refer to this comprehensive guide to Singapore’s FD promotions for an overview of current market offerings.

Leave a Reply