We are now on Telegram. Click to join We are now on Telegram. Click to join |

Standard Chartered Bank (Singapore) Limited has refreshed its Singapore Dollar Time Deposit promotion, offering savers a simple way to earn higher short-term returns while keeping risk relatively low.

Update 15 Jan: Standard Chartered time deposit promo offers up to 1.2% p.a. from 15 Jan 2026

From 1 Jan 2026, eligible customers can earn up to 1.25% per annum (p.a.) on fresh Singapore Dollar (“SGD”) funds placed into this promotional Time Deposit. The promotional rates are unchanged from the 1 Dec update; however, the earlier 1-month 1.88% p.a. option is no longer available.

Key features of the promotion

- Applies to Singapore Dollar Time Deposits placed with Standard Chartered Bank (Singapore) Limited from 1 Jan 2026.

- Available tenor: 6 months, suitable for short- to medium-term cash parking.

- Valid only for Fresh Funds credited into eligible accounts before placement.

- Placement can be done conveniently via Online Banking or the SC Mobile app, without visiting a branch 🙂.

Promotional interest rates

Enjoy promotional rates when placing at least S$25,000 in Fresh Funds, subject to the minimum requirements below.

| Tenor | Minimum Placement Amount (Fresh Funds in SGD) | Promotional Interest Rate |

|---|---|---|

| 6 months | S$25,000 | Personal Banking: 1.15% p.a. Priority Banking: 1.20% p.a. Priority Private: 1.25% p.a. |

These promotional rates apply only if the Time Deposit is held until maturity. Early withdrawals may earn reduced or zero interest, depending on the bank’s prevailing policy. Customers should review the full terms carefully. Standard Chartered Singapore Dollar Time Deposit January 2026 Fresh Funds Promotion Terms and Conditions apply. (PDF).

What qualifies as Fresh Funds?

For this promotion, Fresh Funds refer to funds that do not originate from any existing account with Standard Chartered Bank (Singapore) Limited, and funds that are not withdrawn and re-deposited within the last 30 days of opening the Time Deposit.

How to place the Time Deposit via SC Mobile or Online Banking

Customers can place the Time Deposit digitally after transferring Fresh Funds to their Standard Chartered deposit account.

Via SC Mobile

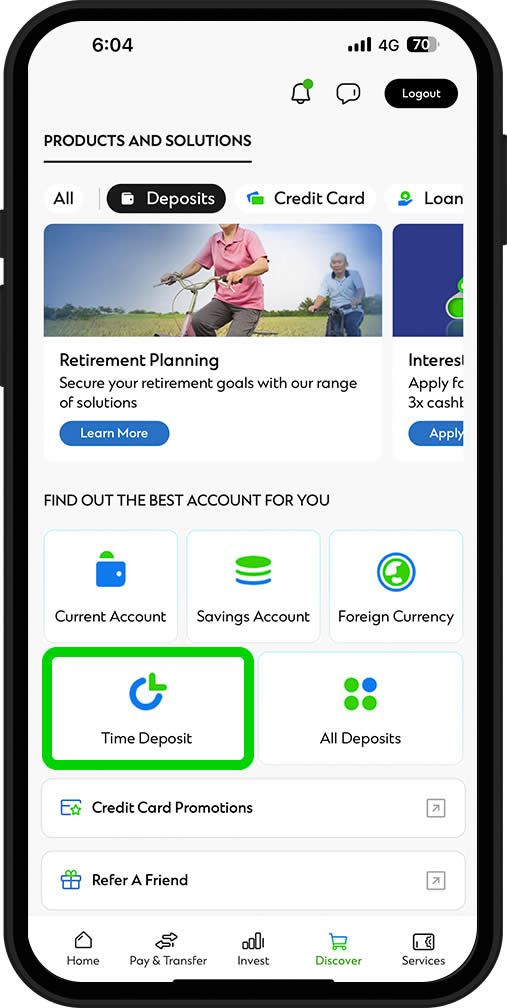

- Log in to SC Mobile.

- Tap Discover (bottom navigation).

- Select Deposits > Time Deposit.

- Choose Singapore Dollar Time Deposit.

- Complete the placement steps shown in-app.

Via Online Banking

- Log in to iBanking and select Apply from the top navigation bar.

- Follow the authentication steps.

- Select the preferred Time Deposit account.

- Fill in the details and submit the application.

The screenshots below show how the placement journey may appear in the app:

Where to find full details

For full information and to start the application, customers can visit the official campaign page. Customers are strongly encouraged to read the terms and conditions (PDF) to understand eligibility, interest computation and early withdrawal implications.

For wider comparison, customers may also refer to this Singapore deposit rate comparison guide to see how Standard Chartered’s 6-month offer compares with other banks islandwide.

As with any financial product, customers should consider their own liquidity needs, emergency funds and overall financial goals before committing to a 6-month lock-in, and may wish to seek independent financial advice if unsure.

Standard Chartered Bank (Singapore) Limited reserves the right to amend, suspend or withdraw the promotion at its discretion.

Leave a Reply