![]()

Uh oh, the deal has ended

Don't miss out again, get the latest news via

![]()

| Starts | 24 Feb 2017 (Fri) | Ends | 10 Jul 2017 (Mon) |

|---|---|---|---|

| Location | Bank of China |

We are now on Telegram. Click to join We are now on Telegram. Click to join |

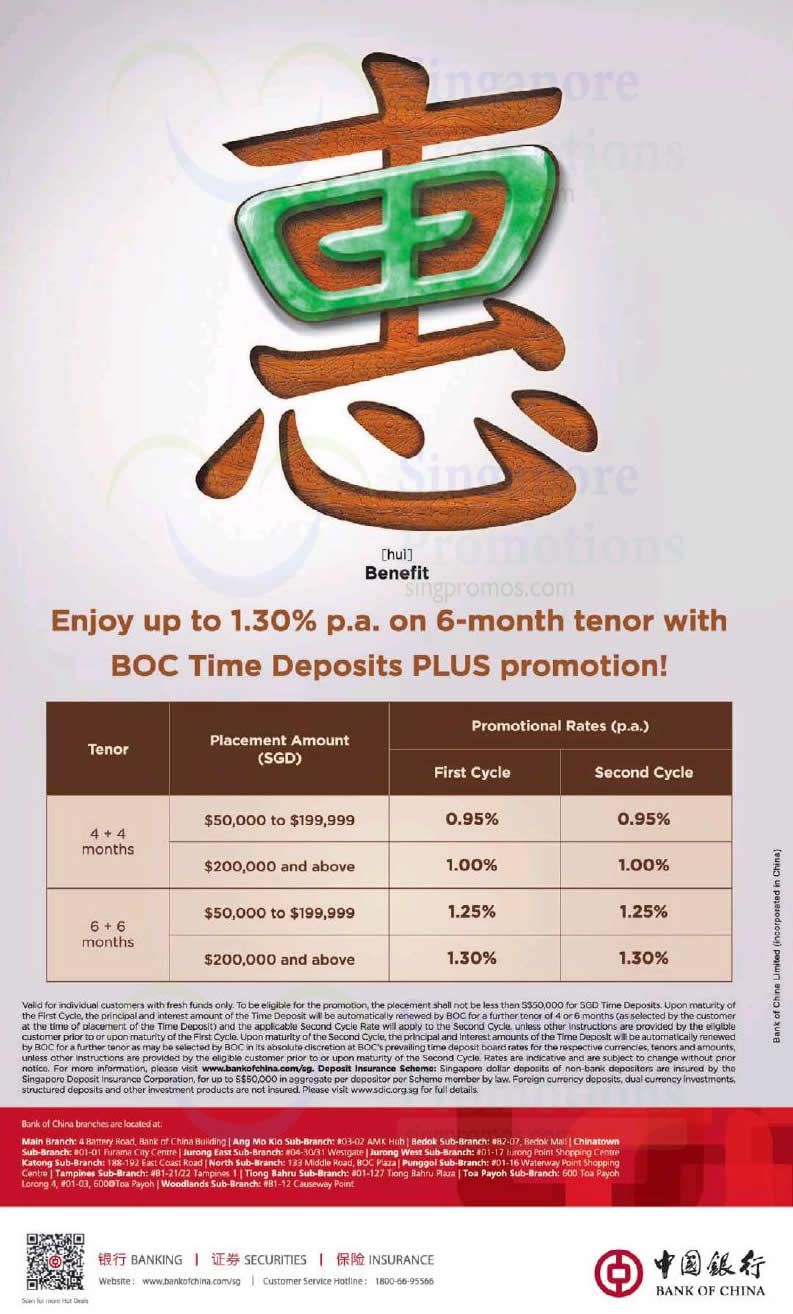

Enjoy up to 1.30% p.a. on 6-month tenor with BOC Time Deposits PLUS promotion! Valid as of 4 July 2017

| Tenor | Placement Amount (SGD) | First Cycle | Second Cycle |

|---|---|---|---|

| 4 + 4 months | $50,000 to $199,999 | 0.95% | 0.95% |

| $200,000 and above | 1.00% | 1.00% | |

| 6 + 6 months | $50,000 to $199,999 | 1.25% | 1.25% |

| $200,000 and above | 1.30% | 1.30% |

Terms & conditions

- The Promotion is valid from 24 February 2017 onward, for a limited time period.

- This Time Deposit PLUS promotion (the “Promotion”) applies to new SGD time deposits (the “Time Deposits”) placed with Bank of China Limited, Singapore Branch (“BOC”) for a tenor of 4 or 6 months (the “First Cycle”).

- This Promotion consists of 2 cycles of promotional interest rates. The first cycle of promotional interest rates (the “First Cycle Rate”) applies to the First Tenor of the Time Deposit. The second cycle of promotional interest rates (the “Second Cycle Rate”) will apply to the renewal of the Time Deposit for a further tenor of 4 or 6 months (the “Second Cycle”) upon maturity of the First Tenor.

- To be eligible for this Promotion, the Time Deposits shall not be less than S$50,000 for SGD Time Deposits.

- This Promotion is only applicable to Time Deposits placed with fresh funds i.e. the funds are not transferred from any existing account with BOC or in the form of BOC’s cheque(s)/cashier order(s)/bank draft(s).

- Customers are allowed to withdraw their Time Deposits upon maturity of the First Cycle without any penalty. The First Cycle Rate will still apply to the First Cycle.

- Upon maturity of the First Cycle, the principal and interest amount of the Time Deposit will be automatically renewed by BOC for a further tenor of 4 or 6 months (as selected by the customer at the time of placement of the Time Deposit) and the applicable Second Cycle Rate will apply to the Second Cycle, unless other instructions are provided by the eligible customer prior to or upon maturity of the First Cycle.

- Upon maturity of the Second Cycle, the principal and interest amounts of the Time Deposit will be automatically renewed by BOC for a further tenor as may be selected by BOC in its absolute discretion at BOC’s prevailing time deposit board rates for the respective currencies, tenors and amounts, unless other instructions are provided by the eligible customer prior to or upon maturity of the Second Cycle.

- BOC’s Terms and Conditions Governing Accounts (as may be amended by BOC from time to time) will apply to a placement of a SGD Time Deposit.

- This Promotion is not valid with any other promotions and cannot be combined or repeated with any existing promotions. The customer shall request for the Promotion when placing the Time Deposit.

- BOC reserves its right to extend, revise or withdraw the Promotion, and is entitled to vary, delete or amend the terms and conditions herein as in whole or part without prior notice.

- The decision of BOC in connection with any matter relating to the Promotion is final, conclusive and binding on all customers and no correspondence or claims will be entertained.

- BOC shall not be responsible nor shall accept any liabilities of whatsoever nature and howsoever arising or suffered by all customers resulting directly or indirectly from this Promotion.

- By participating in this Promotion, the participants agree to be bound by the terms and conditions herein including any amendments and variations thereto.

- These terms and conditions shall be governed by the laws of Singapore.

- In the event of any discrepancy or inconsistency between the English version and the Chinese version of the terms and conditions, the English version shall prevail.

- Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. Please visit www.sdic.org.sg for full details.

For more information, please click here

Leave a Reply