We are now on Telegram. Click to join We are now on Telegram. Click to join |

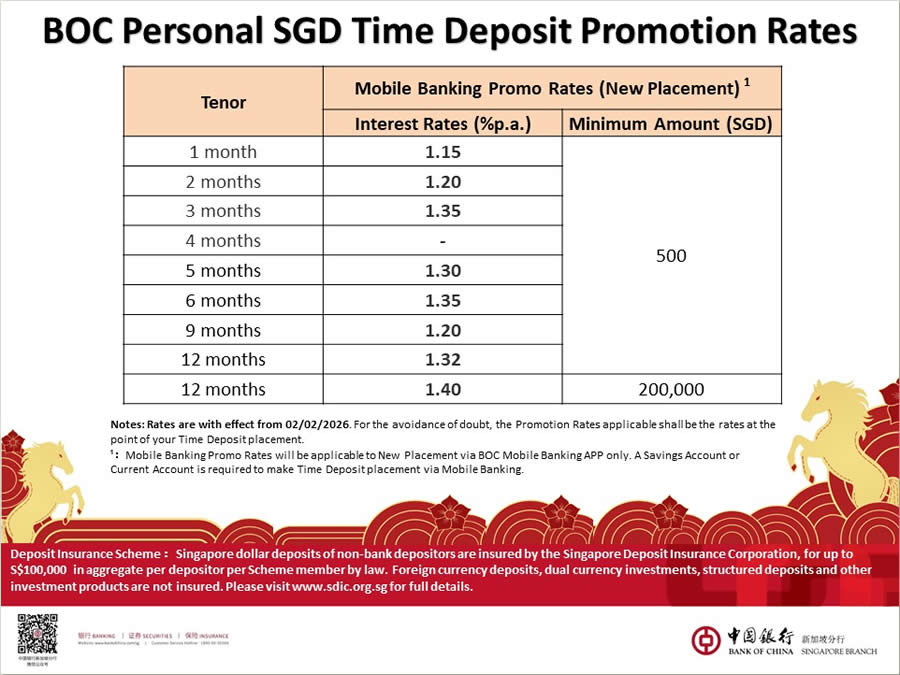

Bank of China (BOC) Singapore has refreshed its Personal SGD Time Deposit (Fixed Deposit) promotional rates for new placements via the BOC Mobile Banking App 📱 from 2 Feb 2026.

For customers who like a known, fixed return over a chosen lock-in period, a time deposit can be a tidy way to put spare cash to work instead of leaving it idle in a regular savings account 😊. It can also help those who prefer a “set-and-forget” approach for earmarked funds (e.g. a planned purchase or emergency buffer), as the rate is fixed for the selected tenor ✅.

Compared with the previous revision on 26 Jan 2026, the 12-month tier with S$200,000 minimum is now higher at 1.40% p.a. (previously 1.35% p.a., a +0.05 percentage point change). As always, customers should check the in-app rate right before confirming.

At a glance

- Top published promo rate: up to 1.40% p.a. (12-month tenor with a higher minimum) 🎯.

- Other notable tenors: up to 1.35% p.a. is also shown for selected shorter tenors with a lower minimum 🙂.

- Channel: BOC Mobile Banking App only (typically labelled New Placement) 📱.

- Minimum placement: mostly from S$500; a higher minimum applies for a specific 12-month tier.

- Tenor availability: a dash “-” means no published promo rate for that tenor.

BOC Personal SGD Time Deposit promo rates (New Placement) 📊

These are the Mobile Banking Promo Rates shown for new placements. Rates are annualised (% p.a.) and the actual interest earned depends on the placement amount and number of days to maturity 😊.

| Tenor | Interest rate (% p.a.) | Minimum amount (SGD) |

|---|---|---|

| 1 month | 1.15 | 500 |

| 2 months | 1.20 | |

| 3 months | 1.35 | |

| 4 months | – | |

| 5 months | 1.30 | |

| 6 months | 1.35 | |

| 9 months | 1.20 | |

| 12 months | 1.32 | |

| 12 months | 1.40 | 200,000 |

Quick illustration (rough) 💡

To help visualise the numbers (simple estimate, before any bank day-count conventions and fees/penalties) 🙂:

- S$10,000 at 1.35% p.a. for about 3 months may earn roughly S$33.75 in interest.

- S$200,000 at 1.40% p.a. for 12 months may earn roughly S$2,800 in interest.

Key terms & practical notes ✅

- App-only + new placement: Promo rates are stated to apply to new placements via the BOC Mobile Banking App only. Branch/other channels may show different rates 🙂.

- Account required: A BOC Savings Account or Current Account is required to place a time deposit via Mobile Banking.

- Rate at time of booking: The applicable promotion rate is the rate shown at the point of placement. Customers are encouraged to review the confirmation screen before submitting ✅.

- Early withdrawal: With most time deposits, breaking early may lead to reduced or zero interest (and may involve fees, depending on bank terms) ⚠️. Customers who need flexibility can consider shorter tenors or splitting funds across multiple maturities (“laddering”) 🪜.

- Renewal behaviour: Some fixed deposits may auto-renew or roll over at prevailing rates unless instructions are selected; customers should follow the on-screen options and confirmation details 👀.

- Funding: Ensure sufficient balance in the linked account before placing to avoid unsuccessful transactions or delays ⚡.

- Risk & coverage reminder: Time deposits are generally lower-risk than market investments, but customers should still review product terms.

How to apply in the BOC Mobile Banking App 📱

Customers can typically complete placement in minutes 😄:

- Log in to the BOC Mobile Banking App.

- Tap Time Deposit, select SGD, then choose the preferred tenor.

- Key in the placement amount (observe the S$500 minimum for most tenors, or S$200,000 for the higher 12-month tier) ✅.

- Double-check the rate shown, maturity date and any early-withdrawal wording displayed on-screen 👀.

- Confirm to complete the placement 🎉.

For a broader comparison across banks and promotions, refer to this updated guide 😊. For official details, visit the BOC Singapore website or locate a branch via the BOC Branch Locator 😊.

Leave a Reply