![]()

Sorry, the deal has ended

Don't miss out again, get the latest news via

![]()

| Starts | 1 Feb 2018 (Thu) | Ends | 23 Feb 2018 (Fri) |

|---|---|---|---|

| Location | Not Specified |

We are now on Telegram. Click to join We are now on Telegram. Click to join |

Earn up to 2.11% p.a. with a minimum $500 in January 2018’s Singapore Savings Bond

Investment amount

- Minimum per bond: $500

- Maximum per bond: $50,000

- Maximum individual holding: $100,000

A safe and flexible way to save for the long term. Savings Bonds are a special type of Singapore Government Securities that is suitable for individuals. Your principal investment and interest payments are backed by the full faith and credit of the Singapore Government.

You will always get your principal back when investing in Savings Bonds. Once a Savings Bond is issued, interest rate changes will have no effect on the bond’s value.

They complement other savings and investments as a safe way to save for the long term.

- Safe – Savings Bonds are fully backed by the Singapore Government. In addition, you can always get your investment amount back in full with no capital losses.

- Long-term – Invest for up to ten years, with interest that increases over time. The longer you save, the higher your return.

- Flexible – Or, choose to exit your investment in any given month, with no penalties. There is no need to decide on a specific investment period at the start.

Issuance details

| Bond ID | GX18030S |

|---|---|

| Amount available | $150 million |

| Issue date | 1 Mar 2018 |

| Maturity date(1) | 1 Mar 2028 |

| Interest payment dates(1) | The 1st interest payment will be made on 1 Sep 2018, and subsequently every six months on 1 Mar and 1 Sep every year. |

| Investment amounts | You can invest a minimum of $500, and in multiples of $500 up to $50,000 for this issue. The total amount of Savings Bonds held across all issues cannot be more than $100,000. |

| Application period | Opens: 6.00pm, 1 Feb 2018 Closes: 9.00pm, 23 Feb 2018 Results: After 3.00pm, 26 Feb 2018 Keep track of the important dates with SSB calendar. |

| Apply through | DBS/POSB, OCBC and UOB ATMs and Internet Banking, OCBC Mobile Application from 7.00am – 9.00pm, Mon – Sat, excluding Public Holidays. On 1 Feb 2018, these channels will be open from 6.00pm to 9.00pm. CPF and SRS funds are not eligible. |

This bond will be reflected as “SBMAR18 GX18030S” in your CDP statement and “CDP-SBMAR18” in your bank statement.

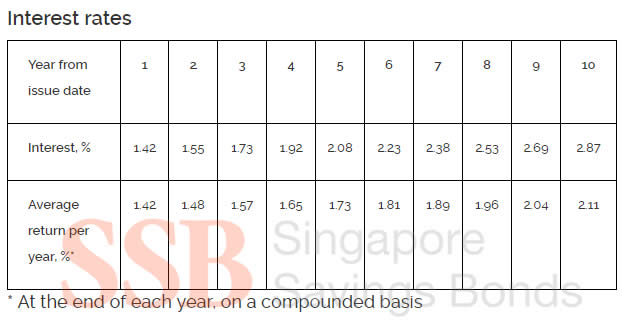

Interest rates

| Year from issue date | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Interest, % | 1.42 | 1.55 | 1.73 | 1.92 | 2.08 | 2.23 | 2.38 | 2.53 | 2.69 | 2.87 |

| Average return per year, %* | 1.42 | 1.48 | 1.57 | 1.65 | 1.73 | 1.81 | 1.89 | 1.96 | 2.04 | 2.11 |

* At the end of each year, on a compounded basis

Calculate the interest you will earn based on your desired investment amount using the Interest Calculator.

(1)If this day is not a business day, payment will be made on the next business day.

For more info, click here

Leave a Reply