![]()

Uh oh, the deal has ended

Don't miss out again, get the latest news via

![]()

| Starts | 3 Jun 2024 (Mon) | Ends | 25 Jun 2024 (Tue) |

|---|---|---|---|

| Location | Not Specified |

We are now on Telegram. Click to join We are now on Telegram. Click to join |

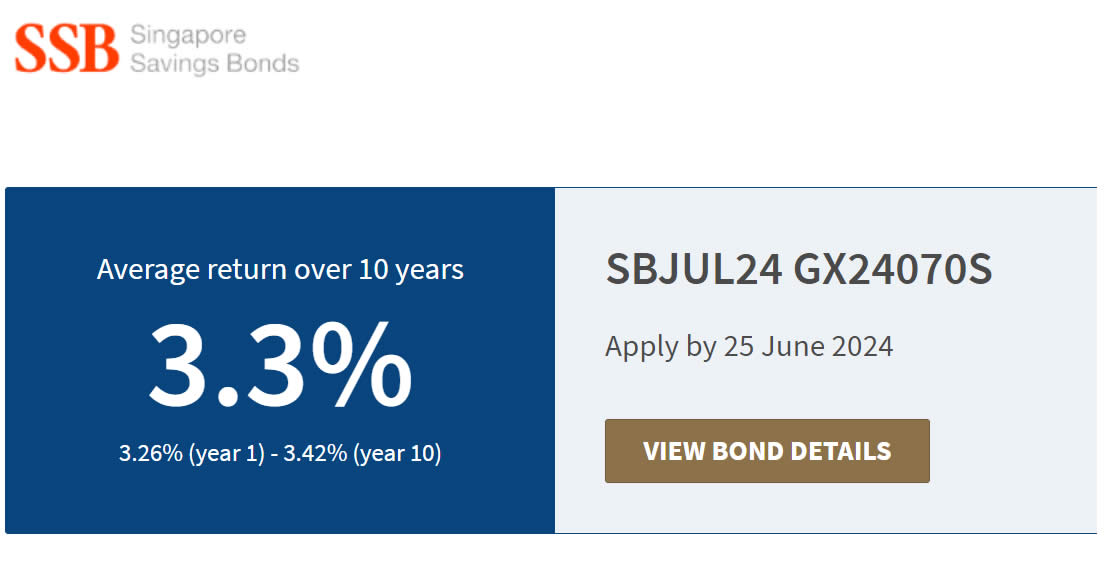

Get an annual return of up to 3.3%,

The SSB scheme, known for its security and flexibility, invites applications with a minimum investment of $500, making it accessible to a broad range of investors.

Key Investment Information:

- Minimum investment: $500 per bond

- No cap on individual bond purchase

- Maximum holding limit: $200,000 per individual

As a low-risk investment, Savings Bonds are backed by the Singapore Government, ensuring both the principal and interest payments are secure.

Investors can rest assured that their initial investment is protected against interest rate fluctuations post-purchase.

Savings Bonds serve as an excellent addition to a diversified savings and investment portfolio, offering a dependable avenue for achieving long-term financial objectives.

- Guaranteed Security

The principal and interest are fully guaranteed by the Singapore Government, providing a risk-free investment. - Long-term Growth

Investors can benefit from a ten-year maturity period with progressively increasing interest, rewarding long-term commitment. - Flexibility

Investors have the option to withdraw their investment at any time without penalties, offering unparalleled liquidity.

Interest rates for the current issue, denoted as SBJUL24 GX24070S, are marginally lower compared to the May 2024 issue.

Interest Rates

The following table illustrates the interest rates for the SBJUL24 GX24070S issue over a ten-year period:

| Year from issue date | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Interest % | 3.26 | 3.26 | 3.26 | 3.26 | 3.26 | 3.26 | 3.29 | 3.38 | 3.42 | 3.42 |

| Average return per year %* | 3.26 | 3.26 | 3.26 | 3.26 | 3.26 | 3.26 | 3.26 | 3.28 | 3.29 | 3.30 |

- For guidance on how to invest in Singapore Savings Bonds, click here.

- Current bondholders looking to withdraw their investments can find instructions here.

- For information on allotment data for previous issues, click here.

- For comprehensive details on Singapore Savings Bonds, click here

Exploring other fixed deposit options? Discover some of the best deposit rates here.

Leave a Reply