We are now on Telegram. Click to join We are now on Telegram. Click to join |

Standard Chartered Bank (Singapore) Limited has refreshed its Singapore Dollar (SGD) Time Deposit promotion for customers looking to lock in a fixed return on fresh SGD funds 😊

With deposit rates moving around quite quickly across Singapore banks, this promo may appeal to customers who prefer a clear, upfront rate for a set period, instead of tracking daily savings rates 😉

From 28 Jan 2026, eligible customers can earn up to 1.65% per annum (p.a.) by placing Fresh Funds (in SGD) into a 6-month promotional Time Deposit. The 6-month tenor is longer than the earlier 23 Jan 3-mth promo rates, which is no longer offered.

As with many bank promos, rates and eligible tenors may be refreshed from time to time, so customers should rely on the rate shown on the bank’s site and/or the confirmation advice at the point of placement 👍

At a glance: who it’s for

- Customers with at least S$25,000 in Fresh Funds (in SGD)

- Those comfortable setting aside funds for 6 months until maturity (i.e., not needed for day-to-day spending)

- Customers in Personal Banking, Priority Banking or Priority Private segments (rates differ by segment)

Promotional interest rates (Fresh Funds in SGD)

To qualify for the promotional rates below, customers need to place at least S$25,000 of Fresh Funds into a 6-month SGD Time Deposit. The headline “up to” rate applies to the highest segment tier 👍

| Tenor | Minimum placement amount (Fresh Funds in SGD) | Promotional interest rate |

|---|---|---|

| 6 months | S$25,000 | Personal Banking: 1.45% p.a. Priority Banking: 1.55% p.a. Priority Private: 1.65% p.a. |

Important: These promotional rates apply only if the Time Deposit is held until maturity. Early withdrawals may earn reduced or zero interest (depending on the bank’s prevailing policy), so customers should review the terms carefully before placing funds. Standard Chartered Singapore Dollar Time Deposit January 2026 Fresh Funds Promotion Terms and Conditions apply. (PDF)

What counts as “Fresh Funds” for this promo? 🤔

For this promotion, Fresh Funds refer to funds that do not originate from any existing account with Standard Chartered Bank (Singapore) Limited, and funds that are not withdrawn and re-deposited within the last 30 days of opening the Time Deposit.

In practical terms, customers typically treat “fresh funds” as money coming in from outside the bank (for example, transferring from another bank account) 😉. Customers who are moving funds around should pay extra attention to the promo definition in the T&Cs (PDF), because placements that fail eligibility checks may be awarded a different (non-promotional) outcome depending on the bank’s stated terms.

How customers can place the Time Deposit (digital placement) 📱💻

After bringing Fresh Funds into an eligible Standard Chartered deposit account, customers can place the Time Deposit through the bank’s digital channels 😊. It helps to double-check the placement screen shows the 6-month tenor and the intended promo rate (where displayed) before confirming 👍

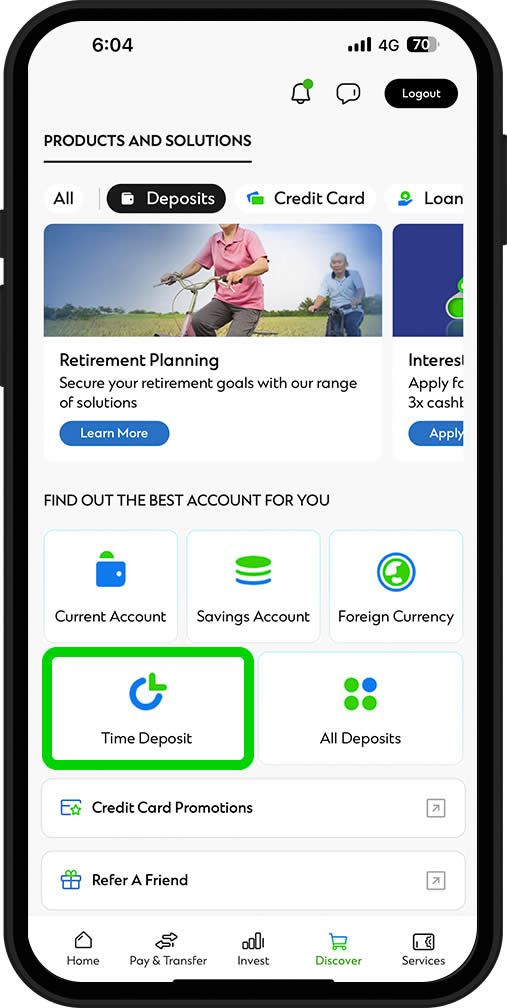

Via SC Mobile 🙂

- Log in to SC Mobile.

- Tap Discover (bottom navigation).

- Select Deposits > Time Deposit.

- Choose Singapore Dollar Time Deposit.

- Follow the in-app steps to complete the placement.

Via Online Banking 😄

- Log in to Online Banking and select Apply from the top navigation bar.

- Complete the required authentication steps.

- Select the preferred Time Deposit account.

- Fill in the placement details and submit the application.

Note: App and iBanking screens may change over time, and some customers may see slightly different labels depending on account type and eligibility 🙂

For reference, the screenshots below show how the placement journey may appear in the app:

Where to check the official details 🔎🙂

For full information and to start the application, customers can visit the official campaign page. Customers are also strongly encouraged to read the terms and conditions (PDF) to understand eligibility, interest computation and early withdrawal implications 😉

For wider comparison, customers may also refer to this Singapore deposit rate comparison guide to see how Standard Chartered’s 6-month offer stacks up against other banks islandwide 🙂

Standard Chartered Bank (Singapore) Limited reserves the right to amend, suspend or withdraw the promotion at its discretion.

Leave a Reply