We are now on Telegram. Click to join We are now on Telegram. Click to join |

Standard Chartered Bank (Singapore) Limited has refreshed its Singapore Dollar Time Deposit promotion, giving customers in Singapore a straightforward way to earn higher short-term returns on their cash while keeping risk low.

Update 9 Dec: Standard Chartered offers up to 1.88% p.a. in Latest FD promo rates from 9 Dec

From 1 Dec 2025, eligible customers can earn up to 1.25% per annum on fresh funds placed into this promotional six-month Singapore Dollar Time Deposit. This round, the rates have increased by up to 0.15% as compared to the 20 Nov update, making this revision especially relevant for savers who have been waiting for a better offer.

Key promotion highlights

- Tenor: six months in Singapore Dollars (SGD).

- Maximum headline rate: up to 1.25% p.a., depending on customer segment.

- Minimum placement: S$25,000 in fresh funds.

- Placement fully online via Standard Chartered Online Banking or the SC Mobile app, without visiting a branch.

- Fixed return over a short six-month period, offering clarity on interest at maturity.

What counts as fresh funds

To qualify for this promotion, customers must place a minimum of S$25,000 in fresh funds. These funds must be newly transferred into a Standard Chartered account for the purpose of this promotion and must not originate from any existing account within the Bank. They also must not be withdrawn and re-deposited within the last 30 days. This requirement ensures the promotion rewards genuinely new deposits, rather than funds simply being cycled between accounts.

Fresh funds refer to funds not originating from any existing account with Standard Chartered Bank (Singapore) Limited (the “Bank”) and funds that are not withdrawn and re-deposited within the last 30 days of opening your Time Deposit.

Promotional interest rates for six months

The promotion currently features a single six-month tenor, with tiered rates depending on the customer segment, as shown in the table below.

| Tenor | Minimum Placement (SGD, Fresh Funds) | Interest Rate (p.a.) |

|---|---|---|

| 6 months | S$25,000 | Personal Banking: 1.15% p.a. Priority Banking: 1.20% p.a. Priority Private: 1.25% p.a. |

The promotional interest rates are only applicable if the Time Deposit is held until the maturity of the six-month tenor. If any early withdrawal is made before maturity, the Bank may require the forfeiture of part or all of the interest awarded at the promotional or preferential rate, in accordance with the applicable terms and conditions. For the full legal wording and specific conditions, customers should refer to the Standard Chartered Singapore Dollar Time Deposit Fresh Funds Promotion Terms and Conditions.

How the six-month Time Deposit works

Once the fresh funds are credited into a Standard Chartered bank account, customers can place their Time Deposit entirely online. There is no need to visit a branch, which is especially convenient for those managing their finances on the go in Singapore.

After placement, the deposit begins earning the stated promotional rate for the full six-month period. The interest is typically paid at maturity together with the principal, giving customers a clear idea of how much they will receive when the Time Deposit ends. This can be useful for planning upcoming expenses or deciding on the next step for their savings.

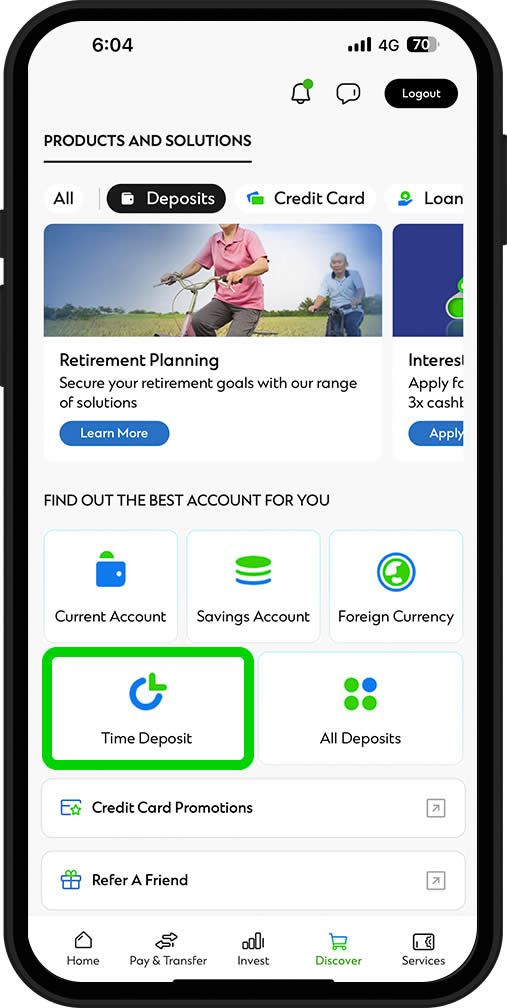

Placing the Time Deposit via SC Mobile app

The SC Mobile app provides a quick, intuitive interface for placing the Time Deposit. The screenshots below illustrate how the placement journey may look within the app for this promotion

Where to find full details

For full details and to start the application journey, customers can visit the official campaign page here. It is strongly recommended to read the terms and conditions carefully so that customers fully understand the eligibility criteria, how interest is computed and the implications of any early withdrawal.

Those who are comparing across different banks in Singapore can also refer to this handy Singapore deposit rate comparison guide for an overview of the latest fixed deposit, time deposit and savings promotions available islandwide.

Who might find this promotion useful

This six-month SGD Time Deposit promotion may be suitable for customers who:

- Have at least S$25,000 in spare cash that is not needed for day-to-day spending over the next six months.

- Prefer a low-risk product with a clearly defined tenor and fixed return in Singapore Dollars.

- Are comfortable with locking in their funds for six months in exchange for a higher interest rate than a typical transactional account.

- Already bank with Standard Chartered Bank (Singapore) Limited or are open to starting a relationship in order to enjoy the promotional rate.

As with any financial product, customers should consider their own cash flow needs, emergency savings and overall financial goals before committing to a six-month lock-in, and may wish to seek independent financial advice if they are unsure whether this product suits them.

Standard Chartered Bank (Singapore) Limited reserves the right to amend, suspend or withdraw the promotion at its discretion, subject to regulatory approvals.

Leave a Reply