We are now on Telegram. Click to join We are now on Telegram. Click to join |

Standard Chartered Bank (Singapore) Limited has refreshed its SGD Time Deposit promotion for anyone looking to lock in a fixed return on Fresh Funds (in SGD) 🙂

Eligible placements starting 20 Feb 2026 earn up to 1.35% p.a. for a 6-month tenor (highest tier applies). Compared with the previous 10 Feb update, the headline rates are lower 🔻, so checking the displayed rate during placement remains important ✅

For anyone preferring certainty over constantly switching savings accounts, a time deposit offers a clear maturity timeline and a known advertised rate 👍

Quick highlights 💡

- Minimum placement: S$25,000 (Fresh Funds in SGD)

- Tenor: 6 months (funds typically held till maturity)

- Available to customers under Personal Banking, Priority Banking, or Priority Private (segment-based rates apply)

- Placement can be done via SC Mobile and Online Banking 📱💻

Promotional rates (Fresh Funds in SGD) 💰

The minimum qualifying placement is S$25,000 into a 6-month SGD Time Deposit. “Up to” refers to the highest eligible segment tier ⭐

| Tenor | Minimum placement amount (Fresh Funds in SGD) | Promotional interest rate |

|---|---|---|

| 6 months | S$25,000 | Personal Banking: 1.25% p.a. Priority Banking: 1.30% p.a. Priority Private: 1.35% p.a. |

Important ⚠

Promotional rates generally assume the placement is held until maturity. Early withdrawal may result in reduced or zero interest depending on the bank’s policy, so reading the full terms matters.

What counts as “Fresh Funds”? 🤔

For this campaign, Fresh Funds are funds that do not originate from any existing Standard Chartered account and are not funds withdrawn and re-deposited within the last 30 days before opening the Time Deposit ✅

In practical terms, qualifying inflows are typically transfers coming in from outside Standard Chartered (for example, another local bank account) 😉. If fund movements are complicated (multiple transfers, recent withdrawals, switching between SC accounts), relying strictly on the T&Cs helps avoid losing promotional treatment ⚠

How to place the deposit digitally 📱💻

After Fresh Funds are credited into an eligible Standard Chartered deposit account, placement can be completed via digital channels. Before confirming, double-check the tenor, amount, and rate shown on-screen ✅🙂

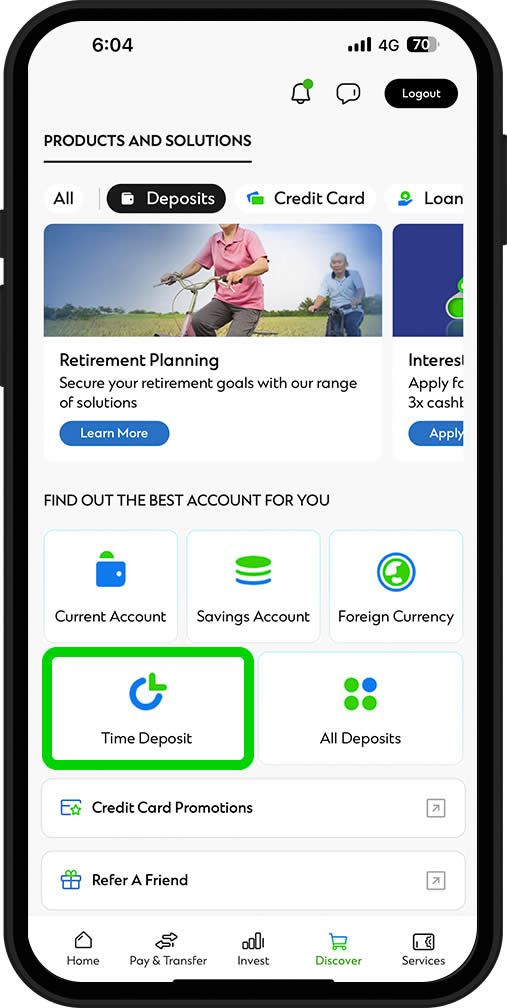

Via SC Mobile 🙂

- Log in to SC Mobile.

- Tap Discover (bottom navigation).

- Select Deposits > Time Deposit.

- Choose Singapore Dollar Time Deposit.

- Follow the in-app steps to submit the placement.

Via Online Banking 😄

- Log in and select Apply from the top menu.

- Complete required authentication.

- Select the preferred Time Deposit account.

- Enter placement details and submit.

Note: Menu labels and screen flow can change with app/web updates and account profiles 🙂

Reference placement visuals 🖼

Practical checklist before locking funds 🧾

- Confirm Fresh Funds eligibility (especially any withdrawals/re-deposits in the past 30 days) 🔎

- Confirm the exact segment tier and rate shown during placement 💹

- Match the 6-month tenor to cashflow needs to avoid early-withdrawal penalties ⚠

- Keep placement confirmation, maturity date, and receipt details for records ✅

- Compare with other bank promos for the same tenor before committing 🔻

Where to verify official details 🔎

For the official campaign information and application start point, visit the official campaign page . For full eligibility rules, interest computation mechanics, and treatment for early withdrawal, read the terms and conditions (PDF) 📄

For broader benchmarking across local banks, refer to this Singapore deposit rate comparison guide and gauge competitiveness for the same 6-month window 🙂

Standard Chartered Bank (Singapore) Limited reserves the right to amend, suspend or withdraw the promotion at its discretion.

Leave a Reply