We are now on Telegram. Click to join We are now on Telegram. Click to join |

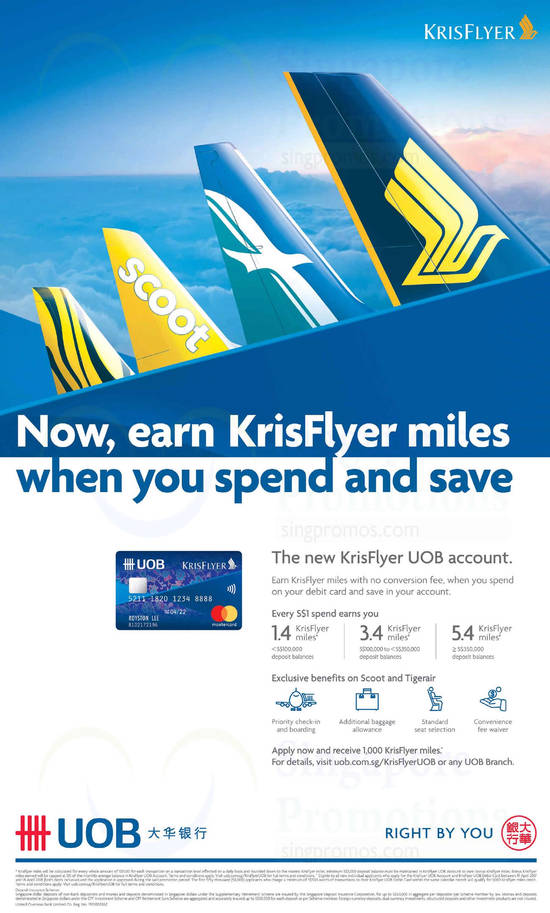

Singapore, 18 April 2017 – United Overseas Bank Limited (UOB) and KrisFlyer1 today launched the KrisFlyer UOB Account, the first banking solution in Singapore to earn KrisFlyer miles when a customer saves or spends.

The KrisFlyer UOB account provides an innovative way for customers who prefer to spend on a debit card or millennials in the early stages of their careers who may not be eligible for a credit card to accumulate KrisFlyer miles.

Customers can use the KrisFlyer miles they earn for award flights and upgrades on Singapore Airlines and SilkAir, or for travel vouchers on Scoot and Tigerair. They will also be able to enjoy complimentary privileges when they travel with the latter two airlines.

Ms Jacquelyn Tan, UOB Head of Personal Financial Services Singapore said the KrisFlyer UOB account rewards customers with KrisFlyer miles for every dollar they spend or save.

“We have seen spend on UOB debit cards grow 40 per cent over the past two years. Travel spend on debit cards also increased 15 per cent in the corresponding period as our customers make more trips abroad.

From our credit card base, air miles are one of our most frequent reward redemption categories and KrisFlyer miles in particular are very popular, accounting for more than half of all UNI$ rewards redemptions made last year. By working in partnership with KrisFlyer, we have brought together two home-grown brands to create an innovative banking solution that earns miles when you save and spend to meet the needs of frequent flyers and millennials,” Ms Tan said.

In 2016, travel accounted for 22 per cent of all spend made on UOB credit and debit cards. Of this, 37 per cent was spent on flights, with the Singapore Airlines Group of carriers the top choice at 60 per cent2.

Singapore Airlines Senior Vice President Marketing Planning, Mr Tan Kai Ping, said, “The KrisFlyer UOB card leverages the wide reach of the KrisFlyer frequent flyer programme, giving card members access to all the airlines within the Singapore Airlines Group. This means seamless access to our four airlines – from full-service carriers Singapore Airlines and SilkAir to budget carriers Scoot and Tigerair – when they spend and save through this account. It is also part of our commitment to constantly enhance the benefits of our KrisFlyer programme, providing members more ways to earn miles for their travels.”

More mileage for your money

With the KrisFlyer UOB Account, customers with an account balance of $350,000 and above will earn 5.4 KrisFlyer miles for every dollar they spend using their KrisFlyer UOB debit card3. For those with an account balance between $100,000 and $350,000, the rate is 3.4 KrisFlyer miles per dollar spent. Account balances between $3,000 and $100,000 will earn 1.4 KrisFlyer miles for every dollar spent, an earn rate that is among the highest in the market.

KrisFlyer miles can quickly add up to award flights. A customer who maintains a monthly average balance of $20,000 in their account and spends $1,000 a month over 12 months will earn 16,800 KrisFlyer miles.

Customers can choose to redeem these KrisFlyer miles for award flights on Singapore Airlines or SilkAir to popular Southeast Asian destinations such as Bali, Langkawi, and Lombok, vouchers on Scoot or Tigerair, or even merchandise from KrisShop4.

A customer with a monthly average balance of $100,000 in their account who spends $1,500 a month over 12 months will accumulate over 60,000 KrisFlyer miles which can be redeemed for a business-class return ticket to Taipei on Singapore Airlines5.

A more comfortable travel experience

The KrisFlyer UOB Account offers cardmembers special privileges on Scoot and Tigerair. Customers who purchase their Scoot or Tigerair tickets using their KrisFlyer UOB debit card on a dedicated site (www.flyscoot.com/KrisFlyerUOB) or via UOB’s mobile banking application UOB Mighty can carry an additional 5kg when they purchase a minimum baggage allowance of 20kg. They will also be given a special one-off promotional code6 which they can then use to offset the convenience fee7 on their next purchase on Scoot or Tigerair. Customers will also enjoy priority boarding and complimentary seat selection.

Customers who are planning their next getaway will find it helpful to visit www.uob.com.sg/KrisFlyerUOB for travel inspiration, with tips on attractions at popular destinations across the globe. The dedicated site, which can also be accessed through UOB Mighty, features a KrisFlyer miles calculator so that customers can determine how much they need to save and spend to meet their travel goals.

With Singaporeans’ love of travel, UOB aims to open at least 200,000 KrisFlyer UOB accounts in the next five years.

Click on image to enlarge

1KrisFlyer – SIA Group’s Frequent Flyer Programme

2Source: UOB data

3Miles earned is subjected to a minimum monthly card spend of $500. Miles earn rate is subjected to the monthly average account balance.

4As at 18 April 2017

5As at 18 April 2017

6The promotional code will be valid for six months.

7Convenience fee is the administrative fee charged when air ticket purchases are made with a debit or credit card.

Leave a Reply