We are now on Telegram. Click to join We are now on Telegram. Click to join |

Here are all the measures the Budget 2016 will be bringing for all households announced by Minister for Finance, Mr Heng Swee Keat, on Thursday, 24 March 2016 at 3.30pm in Parliament.

No business related benefits are listed here

For detailed information, visit www.singaporebudget.gov.sg.

Click here to share this with your friends & loved ones on Facebook!

Click on a link to jump to a specific section

- (A) Caring for Our Young

- (B) Caring for Our Low Wage Workers and Persons with Disabilities

- (C) Caring for Our Seniors

- (D) Other Measures Affecting Households

- (E) Building a Caring Society

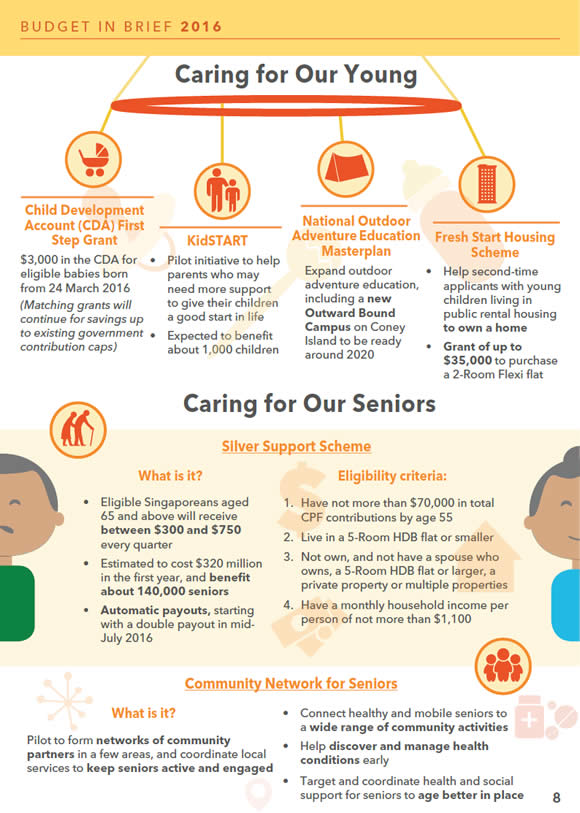

(A) Caring for Our Young

(A1) Child Development Account First Step Grant

To provide more support to Singaporean parents, the Government will:

- Introduce a new Child Development Account (CDA) First Step grant of $3,000 for all eligible Singaporean children. Parents will automatically receive $3,000 in their child’s CDA. Those who save more will continue to receive dollar-for-dollar matching from the Government, up to the existing contribution caps. This will apply to eligible babies born from 24 March 2016.

- Increase the Medisave withdrawal limit for pre-delivery expenses from $450 to $900. This will take effect for births from 24 March 2016.

(A2) KidSTART

This is a pilot initiative for parents who may need more support to give their children a good start in life.

More than $20 million will be spent to provide about 1,000 children with appropriate learning, developmental, and health support in their first six years. More details will be provided at the Ministry of Social and Family Development’s Committee of Supply.

(A3) Fresh Start Housing Scheme

To help eligible second-timer families with young children in rental housing own their own home, the Government will provide such families with a grant of up to $35,000.

The grant will enable these families to own a 2-room flat with a shorter lease. More details will be provided at the Ministry of National Development’s Committee of Supply.

(A4) National Outdoor Adventure Education Masterplan

To develop a sense of adventure and resilience, the Government will expand outdoor adventure education for all students, through a new National Outdoor Adventure Education Masterplan.

As part of this effort, a new Outward Bound Singapore (OBS) campus will be built on Coney Island. It is expected to be ready around 2020, and cost about $250 million. This will provide many more youths with the opportunity to go for an expedition with OBS. These activities will help them build confidence, and develop camaraderie with students across different schools.

More details will be provided during the Committee of Supply by the Ministry of Culture, Community and Youth, and the Ministry of Education.

(B) Caring for Our Low Wage Workers and Persons with Disabilities

(B1) Enhancements to Workfare Income Supplement Scheme ($770 million a year)

The Government will enhance the Workfare Income Supplement (WIS) scheme, which rewards work and supplements the income and retirement savings of older low-wage workers.

- Raise the qualifying income ceiling from $1,900 a month, to $2,000 a month.

- Increase WIS payouts for eligible workers depending on their age and income. Workers will continue to receive 40% of WIS in cash and 60% in CPF.

- Simplify the qualifying criteria for WIS by paying WIS for every month worked. Workers can receive WIS on a monthly basis rather than quarterly.

In total, WIS is expected to benefit 460,000 Singaporeans. These changes will take effect from 1 January 2017.

(B2) Supporting Persons with Disabilities at Work

The Government will extend the Workfare Training Support scheme to persons with disabilities, who earn low wages and are under 35 years old.

The Public Service will play its part in expanding job opportunities for persons with disabilities, with support from SGEnable.

More details on the review of the national Enabling Masterplan will be provided at the Ministry of Social and Family Development’s Committee of Supply.

(C) Caring for Our Seniors

(C1) Implementation of Silver Support Scheme ($320 million for the first year)

The Government will implement the Silver Support Scheme to supplement the retirement incomes of the bottom 20% of our seniors, with some support also provided to the bottom 30%.

The eligibility criteria include:

- Lifetime wages – not more than $70,000 in total CPF contributions1 by age 55. Self-employed persons should also have an average annual net trade income of not more than $22,800 when they were between the ages of 45 and 54

- Housing type – live in HDB flats which are 5-room or smaller. For seniors to qualify, they and their spouses should not own an HDB flat which is 5-room or larger, private property, or multiple properties.

- Household support – Average monthly income per household member of not more than $1,100.

Eligible seniors will receive $300 to $750 every quarter, depending on their flat type.

The majority of seniors living in 1- and 2-room flats, and about half of the seniors living in 3-room flats will receive Silver Support. Silver Support will supplement other forms of assistance they may receive from existing schemes, such as Workfare, healthcare subsidies or GST Vouchers.

The scheme will benefit more than 140,000 seniors, and will cost close to $320 million in the first year.

(C2) Community Networks for Seniors

The Government will pilot Community Networks for Seniors, to help seniors stay active, healthy, and meaningfully engaged. At the core, these networks will have a small team of full-time officers who will study the health and social needs of seniors and draw together local stakeholders and volunteers to provide coordinated support.

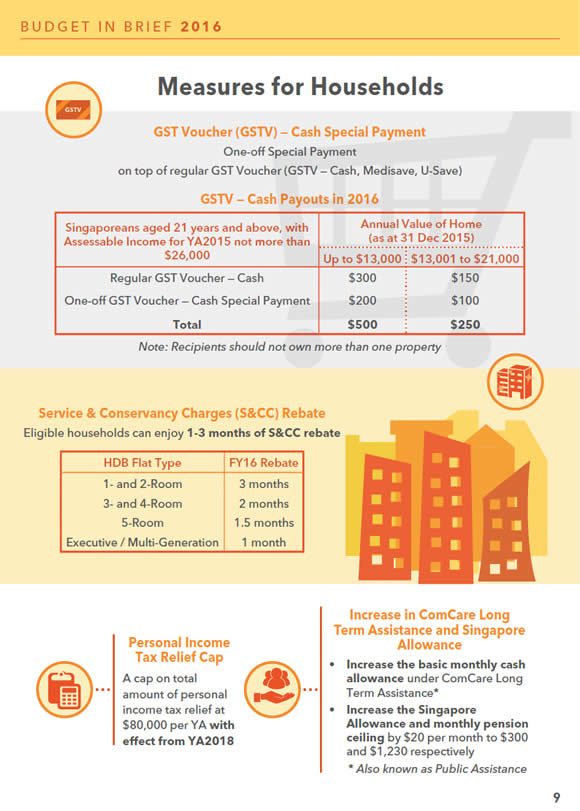

(D) Other Measures Affecting Households

(D1) Increase in ComCare Long Term Assistance and Singapore Allowance

The Government will:

- Raise the basic monthly cash allowance of persons on ComCare Long Term Assistance. For example, a two-person household will now receive an additional $80 a month, bringing the amount of cash assistance to $870.

- Increase the Singapore Allowance and monthly pension ceiling for pensioners by $20 per month each – to $300 and $1,230 respectively. This will benefit about 10,000 pensioners.

(D2) One-off GST Voucher (GSTV) – Cash Special Payment

To support households amid current economic conditions, the Government will provide a one-off GSTV- Cash Special Payment of up to $200 for eligible GSTV – Cash recipients. In total, eligible households can receive up to $500 in GSTV – Cash in 2016.

The one-off GSTV-Cash special payment will cost an additional $280 million in 2016 and benefit 1.4 million Singaporeans.

(D3) Service & Conservancy Charges (S&CC) Rebate

To help households with their general household expenses, the Government will provide S&CC rebates in 2016:

This will cost the Government about $85 million and benefit about 840,000 HDB households.

(D4) Personal Income Tax (PIT) Relief Cap

In order that the PIT reliefs that have been introduced and enhanced over the years do not unduly reduce total taxable incomes, the Government will introduce a cap on the total amount of such reliefs an individual can claim, at $80,000 per Year of Assessment.

The personal income tax relief cap will take effect from Year of Assessment 2018.

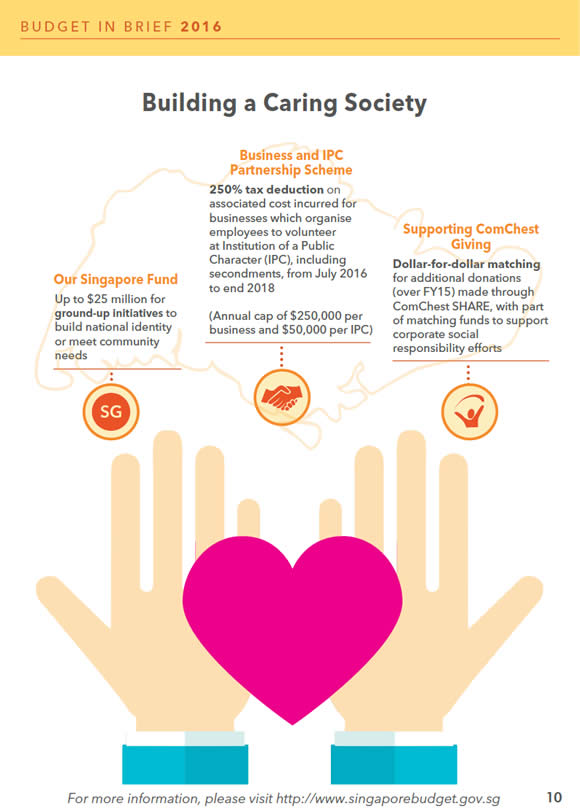

(E) Building a Caring Society

(E1) Business and IPC Partnership Scheme

To encourage businesses to support their employees’ volunteer activities with Institutions of Public Character (IPCs), the Government will introduce a pilot Business and IPC Partnership Scheme.

From 1 July 2016 till the end of 2018, businesses that send their employees to volunteer and provide services to IPCs, including secondments, will receive a 250% tax deduction on associated cost incurred, subject to the receiving IPC’s agreement. This deduction will be subject to a yearly cap of $250,000 per business and $50,000 per IPC.

More details will be provided subsequently.

(E2) Supporting Community Chest Giving

To further support the work of the Community Chest (ComChest), the Government will provide dollar-for-dollar matching for any additional donations through ComChest’s monthly donation programme, SHARE, over and above the FY15 level. This dollar-for-dollar matching will be for 3 years, starting from April this year.

Businesses which encourage their staff to donate regularly will be allowed to use part of the matching funds to organise Corporate Social Responsibility activities. More details will be provided at the Ministry of Social and Family Development’s Committee of Supply.

(E3) Our Singapore Fund

To catalyse ground-up initiatives, the Government will set up a new fund, called Our Singapore Fund. The Fund will support projects that build the spirit of caring and resilience, nurture our can-do spirit, and promote unity and our sense of being Singaporean.

The total fund size will be up to $25m and it will be set up by the second half of 2016.

More details will be provided at the Ministry of Culture, Community and Youth’s Committee of Supply.

Visit www.singaporebudget.gov.sg for more information.

Leave a Reply